We have much more to do and your continued support is needed now more than ever.

Oil Tax Breaks Targeted by Lawmakers

TAKE ACTION NOW TO STOP TAX BREAKS FOR BIG OIL!

Disproportionate spending cuts hit conservation and environment programs in the last budget agreement, and more drastic cuts are likely to be proposed. As the oil and gas industry enjoys record profits and consumers pay up to $4.00 a gallon for gas, Congress President Obama are considering eliminating or reducing unnecessary industry tax subsidies and use some of the savings to restore ideological conservation cuts and invest in a jobs-producing, clean energy economy that reduces our addiction to oil.

Senate Democrats are pushing legislation this week and next and actively seeking Republican support. A hopeful sign. You can help by writing lawmakers right now at the link above.

“It is encouraging that some Republicans have publicly expressed a willingness to consider supporting legislation to cut wasteful subsidies for oil companies and we look forward to working with all of you to lower the deficit,” Senator Majority Leader Harry Reid and Senator Robert Menendez wrote today. “If we are to truly address our national debt, we will all have to tighten our belts and make sacrifices – even the most wealthy and powerful among us.”

They go on to not the Big 5 oil companies have made nearly $1 trillion in profits in the last decade – and more than $30 billion of that in the first three months of this year alone.

Oil and Gas Tax Breaks

• Raking in Profits While Americans are Hurting. Royal Dutch Shell turned a $6.9 billion profit in the first quarter of 2011, a jump of more than 40 percent from the same period a year ago. Excluding one-time gains or expenses, the company netted nearly $6.3 billion for the quarter. Exxon says it earned nearly $11 billion in the first quarter, a performance that will likely land it in the center of the national debate over high gasoline prices. The world’s largest publicly traded company on Thursday reported net income of $10.65 billion, or $2.14 per share, in the first three months of the year. That compares with $6.3 billion, or 1.33 per share. Revenue increased 26 percent to $114 billion.

• Polls Say Big Oil Breaks Should Go. Enshrined for too long in our tax code, oil and gas tax loopholes and high profits add “salt to the wounds” for families who are paying almost $4.00 a gallon for gasoline to fuel their cars, up over $1.00 from last year. A February poll found that 74 percent of voters support eliminating tax breaks to oil companies (NBC/Wall Street Journal).

• Congress Protecting Big Oil. Tax deductions and credits favoring the oil and gas industry represent funds lost to the Treasury that could help reduce the deficit. Yet Rep. Paul Ryan’s 2012 budget leaves intact $40 billion in subsidies over the next ten years for Big Oil. The $40+ billion in subsidies to the oil and gas industry are funds that could be redirected to developing clean energy, spurring energy conservation and supporting conservation.

Drilling a False Solution

Domestic Production Spiking. The calls for more drilling may please oil lobbyists who have a tight grip on the House, but supply is a false issue. The Financial Times reported on March 3rd that U.S. domestic oil production has actually risen to its highest level since 2002. “According to the U.S. government’s Energy Information Administration, domestic production of crude oil and related liquids rose 3 percent last year to an average of 7.51m barrels a day – its highest level since 2002.”

House is Captured by Big Oil

• Pushing Polluter Riders. Instead of repealing outmoded tax subsidies, the House has pushed polluter riders that would gut the Clean Water Act and Clean Air Act. Meanwhile, it continues to protect subsidies that have propped up the oil and gas industry, perpetuated our dependence on imported oil, addict us to dirty fuels and cause harmful carbon pollution.

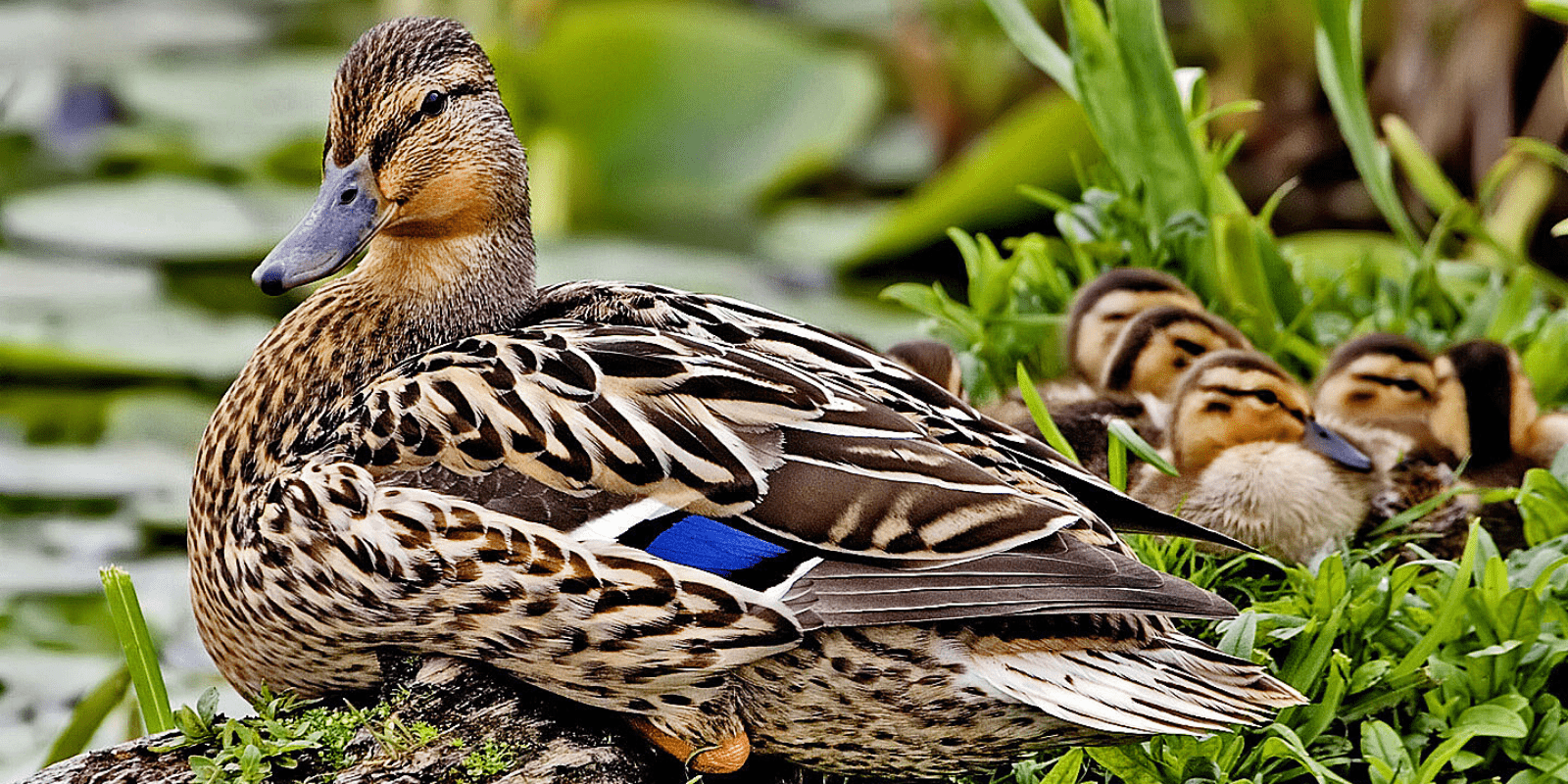

• Pushing Earmarks for Oil. House members also pushed legislation to exempt oil companies from environmental protection laws and to allow so-called “exploratory” drilling off Alaska’s coasts, areas that are home to polar bears and other Arctic wildlife, marine life and areas that should be protected. These “oilmarks” go the wrong direction.

• Backing Subsidies. Last month, the House of Representatives killed an amendment, 176 to 249, to eliminate them. Rather than passing true reforms that encourage innovative, clean energy development, the House is devoted to the polluting fuels of yesteryear.

White House Intervenes and Senate Plans Vote

• Responsible Action. President Barack Obama included in his 2012 budget proposal to eliminate a series of oil industry tax breaks, steps that could save around $44 billion from 2012 to 2021. Senate Majority Leader Harry Reid is also planning a series of votes to end the subsidies. Rep. Earl Blumenauer has also introduced legislation in the House to end the subsidies.

• Tackling Illegal Market Manipulation. The Justice Department is also planning to investigate whether there is fraud or manipulation in the retail and wholesale oil markets, practices like illegal trading or speculating that are driving up gasoline prices. The Justice Department announced on April 21 that a DOJ-led team will “monitor oil and gas markets for potential violations of criminal or civil laws to safeguard against unlawful consumer harm.”

Limiting Cuts to Conservation Means Jobs

• Restoring Cuts. Fattening the wallets of flush polluters is just about the worst thing to do with federal dollars. Funding conservation efforts instead of wasteful tax subsidies to the oil and gas industry could reverse some of the damage inflicted by Congress in the budget compromise bill. The April bill, now law, whacked $4.7 billion from U. S. Forest Service operations, $1.6 billion from the Environmental Protection Agency and $28 million from state wildlife grants, for example.

• Investing in Jobs. Outdoor recreation contributes $730 billion a year to the U. S. economy, supports nearly 6.5 million jobs and generates $88 billion in annual state and national tax revenue and $289 billion a year in retail sales and services. The almost 90 million Americans who fish, hunt or watch wildlife in the U. S. spent $122 billion in 2006. Preserving our natural resources — parks, refuges, forests, recreation areas, campgrounds, trails, rivers, oceans, meadows, grasslands, mountains and seashores — means jobs and economic growth in numerous communities across the country.

You can help. Take action now!