We have much more to do and your continued support is needed now more than ever.

For Gulf Restoration, Every Dollar Counts

This weekend I had the opportunity to discuss what BP might face at trial for the Gulf oil disaster with some eloquent thought leaders, including Tulane political science professor and MSNBC host Melissa Harris-Perry. We discussed the continuing “unusual mortality event” of Gulf dolphins, the 565,000 pounds of Deepwater Horizon oil that washed ashore only six months ago with Hurricane Isaac, and other continuing impacts of the disaster.

[flash width=”420″ height=”245″ movie=”http://www.msnbc.msn.com/id/32545640″ FlashVars=”launch=51025477^95028^732633&width=420&height=245″]

It’s difficult to quantify the harm in an environmental disaster. The Gulf is enormous and oil gushed from over a mile below the surface of the ocean. Because water and wildlife move, it would be near-impossible to find every bit of damage. Researchers found evidence of Deepwater Horizon oil in pelican eggs in Minnesota last year! To compound matters, the impacts are far-reaching into parts of the ecosystem that scientists don’t know much about. For instance, a substantial amount of the oil moved southwest of the Macondo well and settled into a deep underwater canyon.

But for multinational oil companies like BP, the profits are obvious, and they are high.

BP’s 2012 annual report indicates that Chief Executive Bob Dudley, who spoke at the CERAWeek Energy Industry conference yesterday about just about everything but trial, made $2.67 million last year. In the three years since the spill, BP has netted close to $40 billion, even after covering the cost to cap the well, run ubiquitous “our beaches are open” commercials, pay individual claims and pay the largest corporate criminal penalty by the Department of Justice.

The law that governs oil spills is clear: since profits from offshore drilling are so high and the consequences are so dangerous, unsafe drillers who spill must compensate for all damage and face penalties. This helps discourage putting profits over safety.

Unbelievably, on the day of our panel, the Washington Post ran an editorial arguing that BP should not face severe penalties. The editorial posed the question, “How much is too much for BP?” In what must be a tagline meant for an April Fool’s Day piece, the editorial continued, “A bill anywhere near that large is impossible to justify.” This is precisely why polluters engage in willful blindness to legal requirements: environmental laws are viewed as somehow less legitimate than tax evasion, racketeering, or labor laws. But crime is crime.

Testimony from the trial shows that this multi-billion dollar corporation had an “every dollar counts” mentality that led them to take egregious safety risks to cut costs, resulting in the loss of eleven lives and over 172 million gallons of crude oil spilled in one of the most productive ecosystems in the world. Misplaced sympathy for BP’s liability is akin to taking pity on Ponzi schemers facing punitive damages for their crimes. BP made calculated business decisions to take dangerous shortcuts in search of profit. The only way to prevent such behavior in the future is to balance the scales of justice so that the reward no longer justifies the risk.

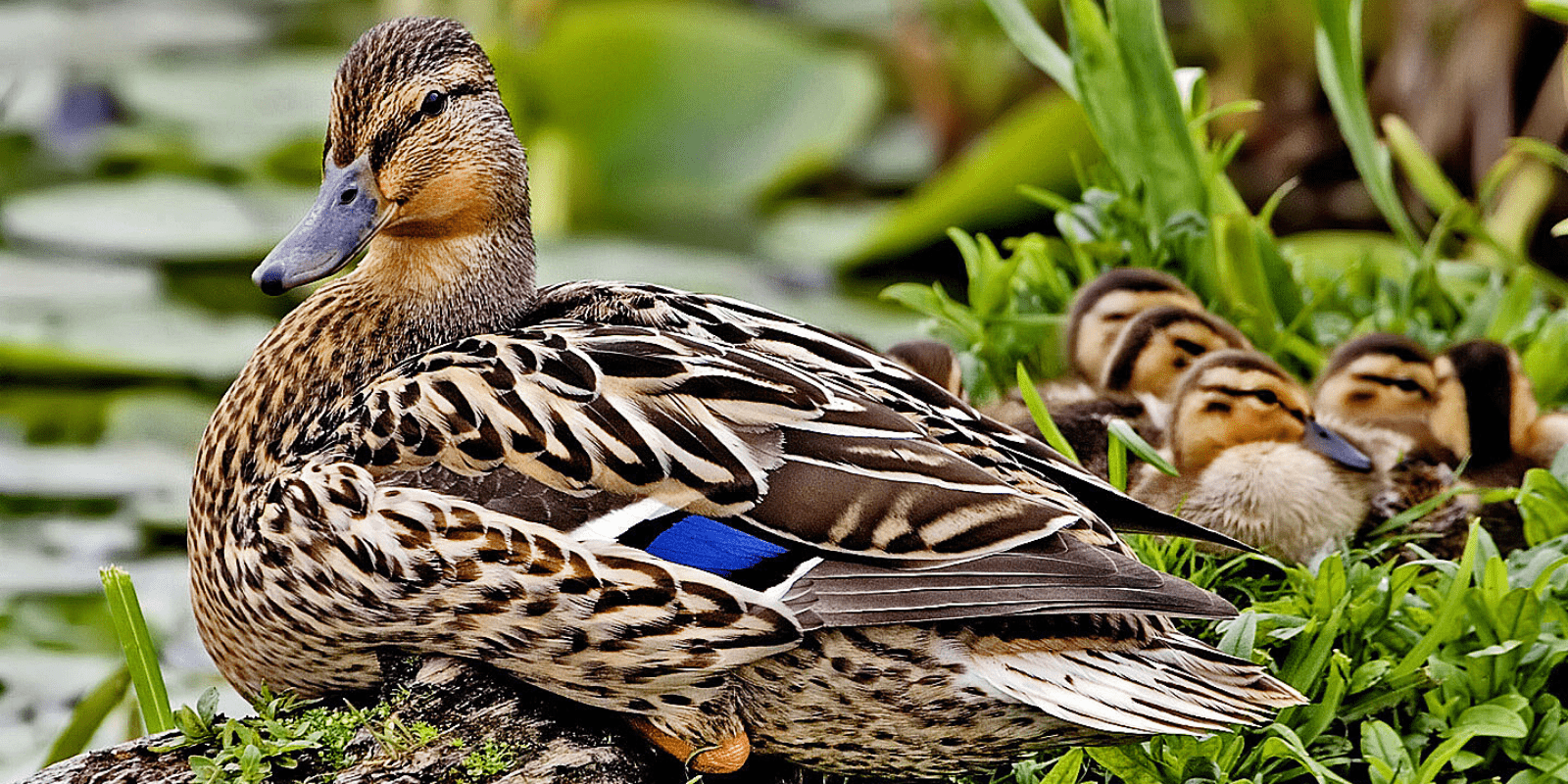

![]() Almost three years after the spill began, the Gulf’s dolphins are still dying in high numbers. Ask the Department of Justice to hold BP fully accountable so we can restore the Gulf of Mexico!

Almost three years after the spill began, the Gulf’s dolphins are still dying in high numbers. Ask the Department of Justice to hold BP fully accountable so we can restore the Gulf of Mexico!