We have much more to do and your continued support is needed now more than ever.

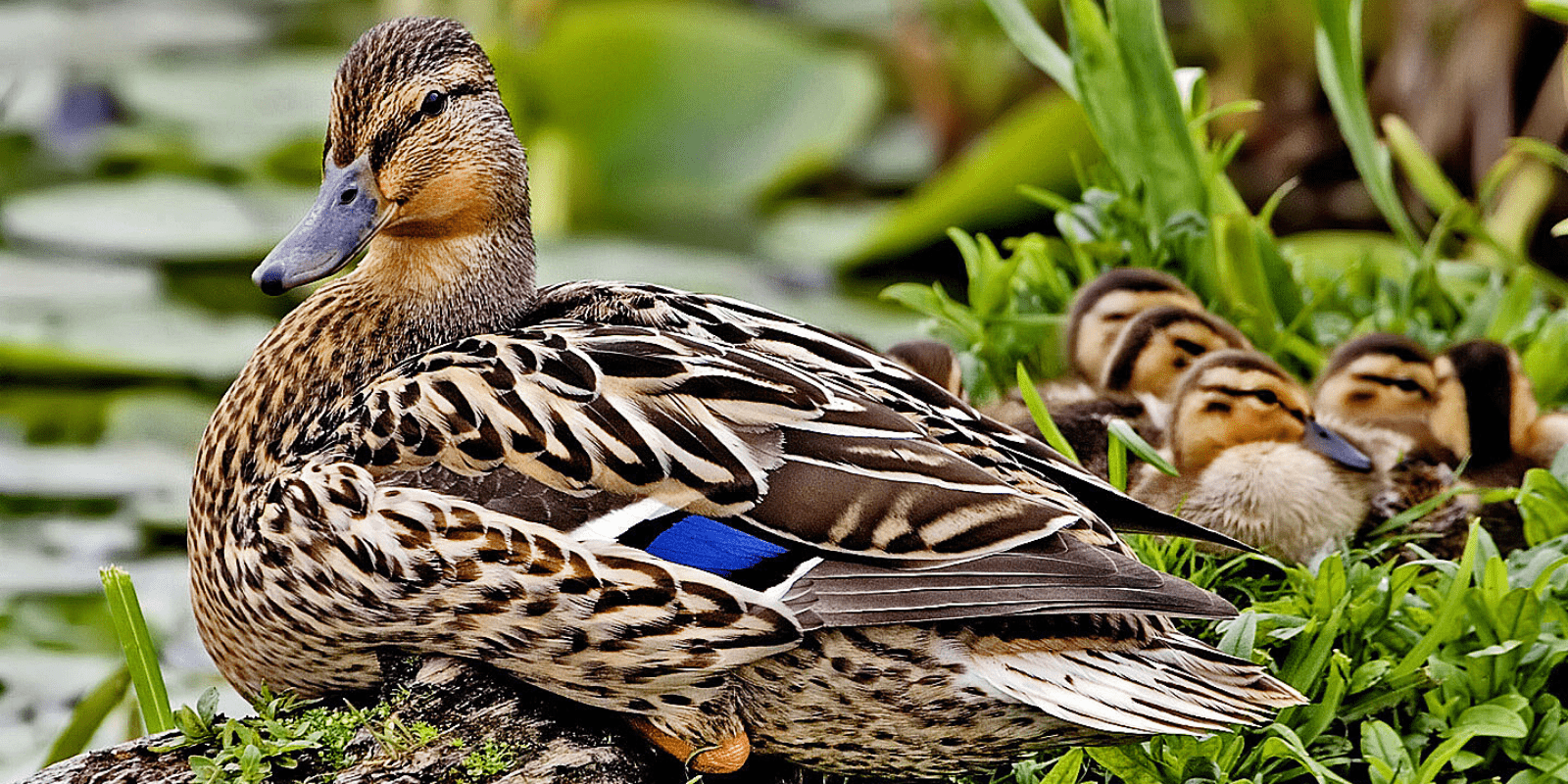

Moving Away From Coal to Help Wildlife

After decades of being the bully in the realm of American fuels, things aren’t going so well for the big coal companies. A string of recent market events has them reeling and has shifted the long-term prognosis for the coal industry distinctly downward.

In short, the drop in the global demand for coal (especially in China) and its lack of competitiveness with natural gas has reduced its price. As an example, the current price of Power River Basin coal is $9.70 per short ton. As recently as September of 2011 it was $14.90.

These market trends have put numerous new coal related projects on hold. Late last year, Arch Coal Company, the outfit requesting a permit for a strip mine in Otter Creek, Montana, filed for bankruptcy. Just a few weeks after that, the Tongue River Railroad Company, a subsidiary of Arch Coal, asked the U.S. Surface Transportation Board to suspend the permitting of a new railroad spur essential to the cost-effectiveness of the proposed Otter Creek Mine.

Many politicians and big businesses tied to coal want to blame proposed new government regulations that will address clean air, climate change, and land use for the tailspin the coal companies are in. It is true that the Environmental Protection Agency’s Clean Power Plan, the Washington State Legislature’s proposals to divest from Montana’s dirty Colstrip Power Plants, and the Bureau of Land Management’s recently proposed coal leasing moratorium will decrease the use of coal. But the impact of these regulation changes on the use of coal will be negligible compared to what the invisible hand of the market is doing to it.

The impact of these market forces is even more amazing considering the external costs associated with burning coal aren’t really even incorporated into its pricing. The burning of coal is the number one culprit driving climate change, which is already causing significant economic problems, and it is predicted by many experts to have even more dire consequences for the global economy in years to come.

Our ecological and economic future is dependent on moving away from coal and investing in clean energy sources. We must move forward, not backwards. The development of projects like the Otter Creak Coal Mine and the two remaining coal ports proposed in Washington are not forward thinking. Let’s officially take them off the table and put our investments into clean energy projects that look to the future. Government proposals like the Clean Power Plan and the Coal Leasing Moratorium do look to the future. They are worthy of our support.

Join NWF Join the National Wildlife Federation and help us continue our work to protect wild lands and wildlife from climate change!