We have much more to do and your continued support is needed now more than ever.

A Season of Tax Credit Guidance

Updates on some of the clean energy tax credits included in the Inflation Reduction Act

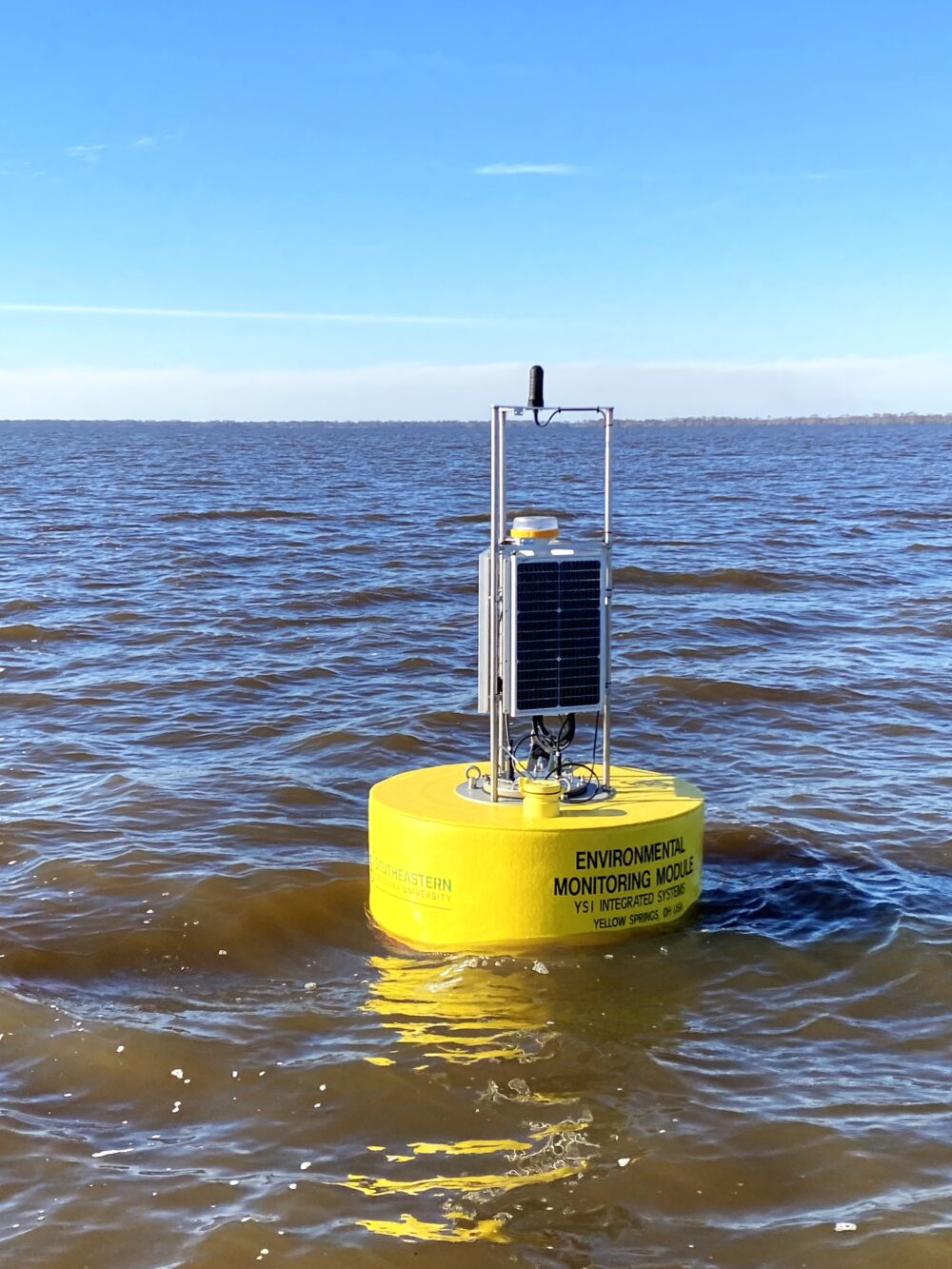

It’s been over a year since the passage of the Inflation Reduction Act, a bill with massive investments in climate and clean energy that ReImagine Appalachia, alongside many other partners, fought hard for. IRA has already made waves in the clean energy industry, with more than $270 billion in new private clean energy investments and 170,000 new jobs. The solar industry alone is expected to add a record amount of gigawatts of new capacity in 2023, thanks in part to IRA.

A bulk of IRA’s clean energy investments come in the form of tax credits for clean energy generation, which will enable the U.S. to produce more energy from wind and solar, more quickly. The bill includes extensions of existing tax credits and new tax credits designed to further spur clean energy production. Each of the tax credits is available for direct pay and transferability, funding methods that preserve more of the credit’s value.

The tax credits carry bonuses for meeting high-road labor standards (prevailing wage and apprenticeship requirements), and if projects are located in energy communities or low-income communities. Over the summer, the U.S. Department of Treasury and Internal Revenue Service (the administering agency for all tax credits) have been releasing guidance on exactly how entities can access those bonuses—which should drive more investment into Appalachian communities, and that should help create more family sustaining union jobs.

Energy Community Tax Credit Bonus

The Energy Community Tax Credit Bonus supports projects located in energy communities, which the IRS has defined as brownfield sites, and census tracts where a coal mine closed after 1999 or a coal-fired power plant closed after 2009. Census tracts directly adjoining those areas also qualify. The bonus is also available to projects in communities that meet certain criteria for both unemployment rate, and fossil fuel tax revenue.

To qualify for the bonus, communities (technically, a metropolitan statistical area or non-metropolitan statistical area, which are basically groups of counties) must have or have recently had at least 0.17 percent direct employment, or at least 25 percent local tax revenues, related to the extraction, processing, transport, or storage of coal, oil, or natural gas, and an unemployment rate at or above the national average unemployment rate for the previous year.

Curious whether your community qualifies as an “energy community” under this definition? The federal government has released this interactive map that shows communities that have had coal mine or coal-fired power plant closures, as well as communities that meet the unemployment and tax revenue criteria.

Low-Income Communities Tax Credit Bonus

The Low-Income Communities Tax Credit Bonus supports eligible scale solar and wind projects in low-income communities or on Tribal land. To be eligible, solar and wind projects must have a maximum net output of less than 5 megawatts (MW). This bonus credit will be allocated to 1.8 gigawatts (GW) of wind and solar capacity per year.

For 2023, IRS and the Department of Energy have divvied up that 1.8 GW across four categories: 700 MW for projects located in low-income communities, including residential rooftop solar; 200 MW for projects on Tribal lands; 200 MW for projects that are part of qualified low-income residential buildings; and 700 MW for projects that provide economic benefits to low-income households. This map shows census tracts that meet the low-income community threshold.

Prevailing Wage and Apprenticeship Requirements

The prevailing wage and apprenticeship requirements are designed to ensure IRA’s clean energy investments create good, safe jobs. These requirements have long been applied to projects supported by federal contracts, but they’ve been applied to clean energy tax credits for the first time, thanks to IRA.

In this blog, our partners at the BlueGreen Alliance break down what these requirements are, and how they help set the stage for a union clean economy.

Repurposing Energy Assets Initiative

Though not tax credit guidance, another exciting bit of DOE news this summer was the Capacity Building for Repurposing Energy Assets initiative, which aims to help communities repurpose retired (or soon-to-be retired) coal, oil and natural gas power facilities, and associated infrastructure. The initiative will provide up to $3.5 million to help communities build technical capacity, and provide access to planning and other resources so communities can develop a roadmap for future use of these assets. This could include the many shuttered coal plants across Appalachia—once the main source of good jobs and foundation for economic prosperity, and now too often blighted properties.

Our partners at ReImagine Appalachia are hosting a summit on redeveloping shuttered coal plants on Thursday, October 5th from 3-5pm EST; register here to join the conversation about how communities can use these DOE funds, or resources like it, to turn liabilities into assets.