We have much more to do and your continued support is needed now more than ever.

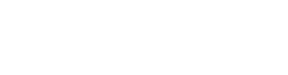

Can we save songbirds with … tax policy?

How Congress Can Spur Smart Investments in Clean Energy, Cars

Climate change is one of the biggest threats to wildlife, exacerbating the habitat loss and increase in invasive species and wildlife disease that threaten many species across the country. Further, as the timing of seasons shift, migratory birds are challenged to time migrations to match with peak food availability. Combined with the worldwide collapse of insect populations, this could spell disaster for many songbird species. The situation is dire, and is quickly becoming a worldwide crisis. We need action now.

Fortunately, a bipartisan climate solution is within reach: there is a unique legislative opportunity that can drive high-impact, smart investment in all of the following categories:

Yes, it’s true—we can do it all at the same time. This immediate window to influence climate change is possible through key investments in a “tax extenders” bill, i.e., legislation to expand existing tax credits.

While such legislation is slightly more obscure than other climate change bills, it still has a good chance to result in significant progress by renewing and broadening temporary tax breaks for low- and zero-carbon energy and transportation technologies.

These investments help pro-climate solutions compete on a more even playing field with heavily subsidized fossil fuels, until a time when all energy and transportation sources will be valued based on their impact to the climate (such as through a fee on carbon pollution, or a technology-neutral clean energy tax credit tied to greenhouse gas performance).

Take action for songbirds today: tell Congress to invest in clean energy innovation!

Take Action!

Innovation through tax policy: a deep dive

Clean Energy

Smart investments in clean energy through tax credits have resulted in incredible success stories. The Solar Investment Tax Credit (ITC) has helped spur solar energy innovation over the last decade, making it one of the fastest growing sources of energy in the U.S. Since the ITC was enacted in 2006, the U.S. solar industry has grown by more than 10,000 percent. Further, the Production Tax Credit (PTC) helped establish the booming wind energy industry and drove down costs by 69 percent over the last decade. In addition to extending these two credits, we now need to offer the same industry-boosting support to new clean energy frontiers, such as offshore wind.

Offshore Wind Energy: The New Clean Energy Frontier

Offshore wind power has great potential to help America forge a clean, independent energy future—and to protect wildlife every step of the way. To set this new industry up for success, we must make sure legislation accounts for the vastly different deployment and investment needs between onshore and offshore wind. Decoupling these two different industries in tax law is an important first step to driving offshore wind towards its full potential. We urge Congress to acknowledge the difference between onshore and offshore wind, and extend an investment tax credit specifically for offshore wind by modifying Sec. 48 of the tax code for qualifying advanced energy projects.

Energy storage

It’s common sense that wind turbines only produce energy when the wind is blowing, and solar panels only work when the sun is shining. In order to fully scale up these important clean energy technologies, we must make sure we can store energy across the electric grid to cover when production is low. An energy storage tax credit is one of the best ways to drive investment in new technologies and wide scale deployment. Specifically, we ask that Congress extend an investment tax credit for energy storage and spur innovation in energy storage equipment that receives, stores, and delivers energy using new and existing technologies by modifying Sec. 48(a)(3) and Sec. 25D of the tax code.

Energy efficiency

Energy efficiency is one of the cheapest and most effective ways to drive down energy demand, and, in turn, climate pollution. Smart investment in energy efficiency could also reduce consumers’ energy bills and save Americans money. Specifically, we urge Congress to drive investment in homeowner efficiency improvements, energy efficient commercial and multifamily buildings and energy efficient new homes by modifying and extending Sections 25C, 179D, and 45L of the tax code, respectively.

Electric vehicles

The transportation sector is one of the largest sources of climate pollution in the United States. Zero and low emission vehicles represent one of the best and most effective opportunities to drive down emissions. We need to invest in these clean technologies and the infrastructure needed to support them. Specifically, we urge Congress to facilitate investment in alternative motor vehicles and alternative fuel vehicle refueling property, and provide tax breaks for qualified plug-in electric motor vehicles. This could be done by extending Sec. 30B and Sec. 30C, and modifying Sec. 30D of the tax code.

Credit: Wikimedia Creative Commons

Carbon removal

The climate science is clear that, if we are to reach climate stabilization goals, reducing what cars, factories, and power plants emit won’t be enough. We will also need to capture carbon dioxide at these sources, as well as pull it out of the atmosphere and store it permanently and safely. In order to deploy carbon removal technologies on the scale needed (probably billions of metric tons), we must quickly increase investment in research and development of carbon capture technologies, as well as options for environmentally-friendly use of captured carbon. Plus, federal policymakers should channel significant funding to strategies that use natural carbon sinks, like forests, to remove more carbon. Specifically, we urge Congress to eliminate the 25,000-ton capture threshold in Sec. 45Q for carbon use projects so smaller projects can qualify, and to fix the Sec. 48A tax credit to enable carbon capture retrofits of existing power plants.

Take Action!