We have much more to do and your continued support is needed now more than ever.

Swans & Solutions: Will We Choose To Face Our Problems?

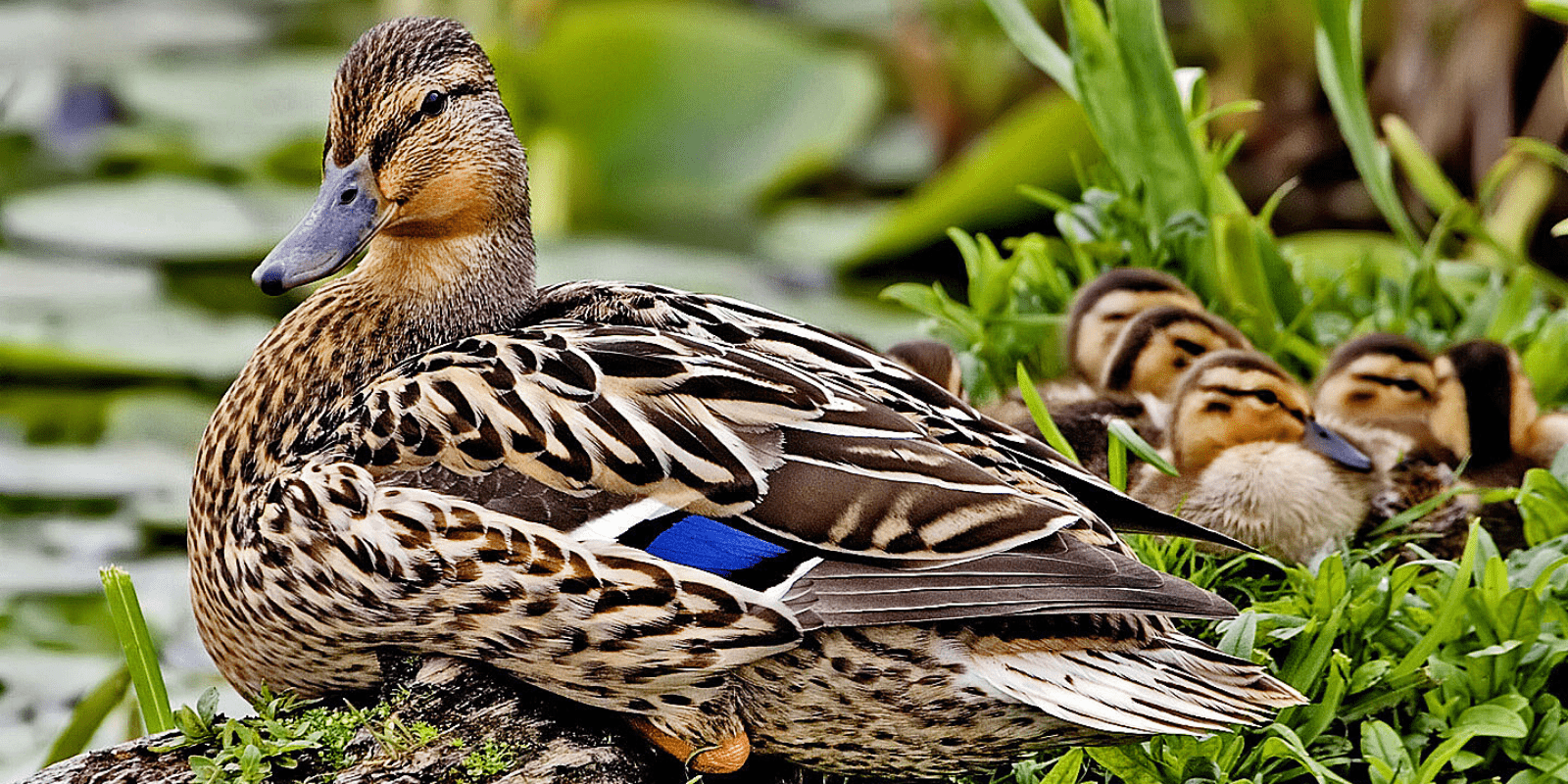

Will we choose not to face our interconnected economic, energy and environmental crises? Washington Post columnist Ezra Klein raises the possibility with a wildlife-themed analogy:

Forget preparing for the “black swans,” investor Nassim Taleb’s name for the unpredictable crises that disrupt and damage our lives. We’ve stopped preparing for what economist Nouriel Roubini calls the “white swans”: the crises we can predict and could even prevent. […]

Last spring, we watched a drilling platform explode in the Gulf of Mexico. Oil prices are gyrating violently, causing pain for consumers and heartburn for economists. And, most important, nine of the 10 hottest years on record were in the past decade. So the Earth is warming and our energy status quo is, quite literally, blowing up in our faces. But are we doing anything about it? Quite the opposite.

Most of the Republicans vying for the 2012 presidential nomination once supported a cap-and-trade plan to curb carbon emissions and move us past fossil fuels. It was part of the McCain-Palin platform in 2008, part of the Jon Huntsman and Tim Pawlenty and Mitt Romney governorships, part of Newt Gingrich’s speeches. Today? They’ve all recanted. And Congress is not seriously considering alternatives, such as real infusions of money into research and development. We’re just watching temperatures climb and prices spike and hoping against all the evidence that this turns out well. […]

When a crisis comes, the people who were charged with preventing it like to say that it could not have been predicted. Who could’ve imagined that housing markets would crash all around the country or that terrorists would fly planes into buildings or a that a hurricane would breach the levees in New Orleans? Sometimes there’s truth to those claims. But not in these cases. These crises are predictable. These crises are preventable. These are the white swans, and they’re swooping and honking right in front of us.

Despite a slight drop in global carbon pollution during the economic downturn, pollution rates have spiked again and we’re right back on the worst case scenario track. As E.J. Dionne writes, our paralysis in the face of crisis is costing America desperately-needed jobs:

Encouraged by Carl Pope of the Sierra Club, I spent time recently with the Wall Street Journal’s report on its annual ECO:nomics conference (PDF), published in March. Right off, the Journal’s account emphasized that China is “grabbing clean-technology market share not because of its cheap labor . . . but through strong mandates and subsidies to build a new export industry.” Ahem, those words “mandates” and “subsidies” don’t come out of the free-market playbook.

The report quoted Mark Pinto, executive vice president of Applied Materials, who said that in solar power, the United States is “neither the largest in manufacturing nor the largest market.” He added: “That’s very unusual.” Do we really want to lose this market?

The International Monetary Fund has also issued a new report showing the United States gets less money from taxes on things like pollution than any other nation in the Organization for Economic Co-operation & Development. That means we have plenty of room to implement something like a carbon pollution tax while allowing businesses to remain more than competitive globally. We’d have plenty of options for what to do with the revenue – close the deficit, offset tax cuts elsewhere, invest in American clean energy jobs, or even just split it up and cut a dividend check to every taxpayer – all while creating a critical incentive to pollute less.

But rather than moving towards a solution, so far this year Congress is moving backwards, refusing to cut billions in subsidies for oil companies that profit from pollution while attacking incentives for clean energy. “It says a lot about the priorities of this Congress that they would protect billions of dollars of oil company subsidies while gutting investments in clean energy alternatives,” NWF’s Jeremy Symons told The Hill. “Big Oil wants our kids to be as hooked on expensive oil as we are today, and clean energy investments are the only way to break the addiction.”