We have much more to do and your continued support is needed now more than ever.

It’s almost Earth Day. Time to think cleaner transportation.

Across town or around the world, moving goods and people is an energy intensive business. In the U.S. the transportation sector is the single biggest contributor to greenhouse gas emissions (GHG), accounting for about 29% of all emissions, according to the Environmental Protection Agency (EPA). Between 1990 and 2019, GHG emissions in the transportation sector increased more in absolute terms than any other sector. Globally, transportation accounts for as much as 20% of emissions every year.

With the approach of the 52nd annual Earth Day celebration, we are reminded again that you can’t solve the climate change problem without addressing transportation. It was with this in mind that IndexIQ launched the CLNR IQ Cleaner Transport ETF (NYSE: CLNR), which is designed to deliver exposure to global companies that support the transition to more sustainable and efficient modes of transportation.

CLNR is a member of the IndexIQ “dual impact” fund family, geared to the needs of values-centered investors. These thematic funds are designed for those who want to position their portfolios to potentially do well while at the same time seeking to have a positive impact on society. The dual impact comes from the fund’s alignment with – and financial contribution to – the mission of a nonprofit related to the fund’s investment strategy.

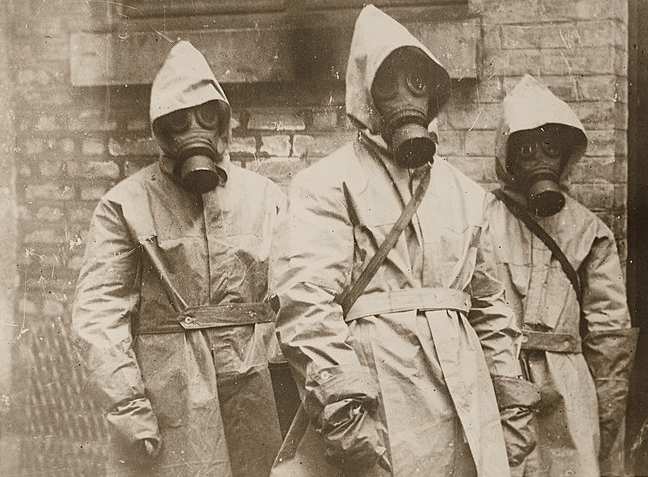

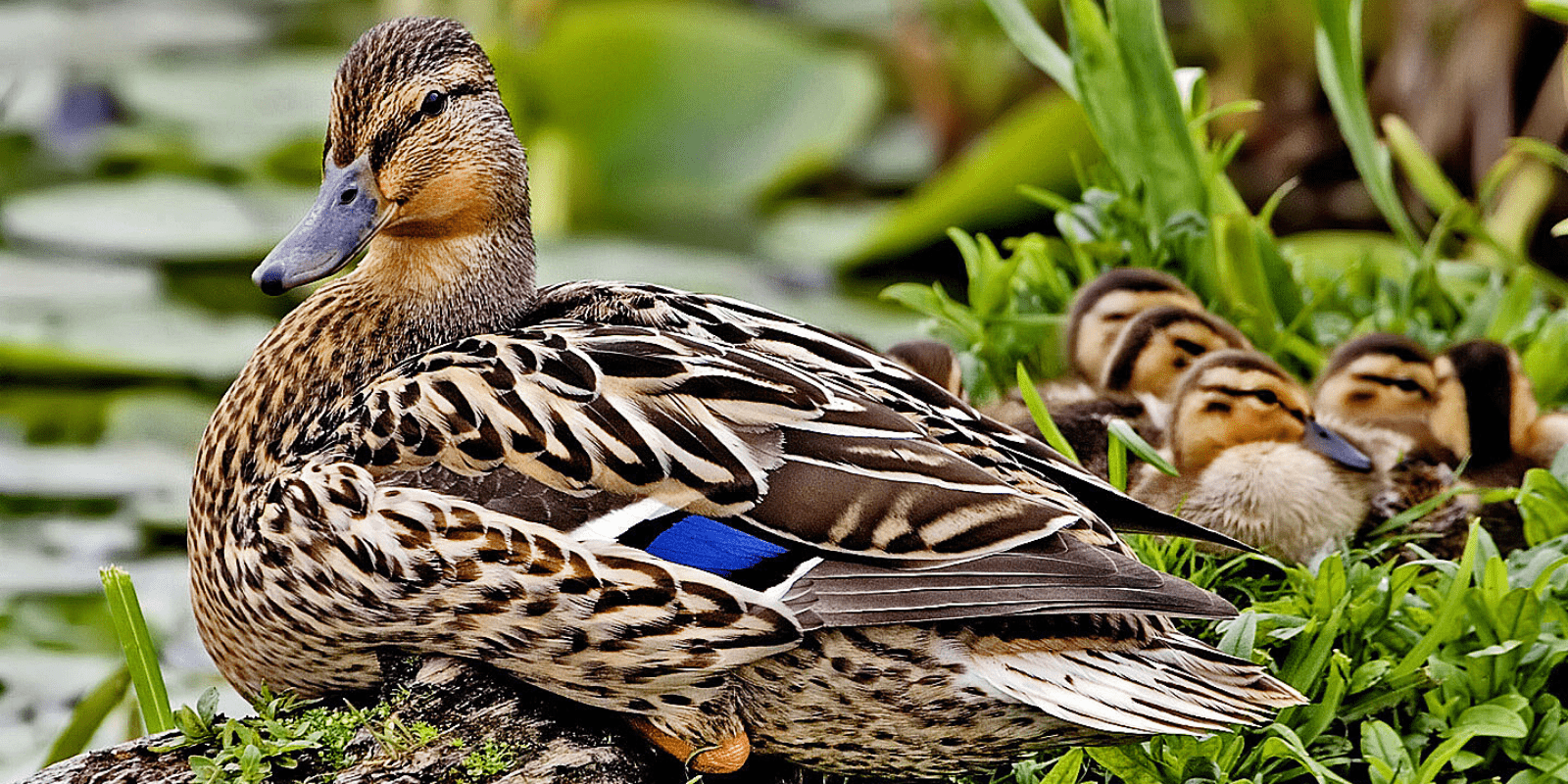

In the case of CLNR, the National Wildlife Federation is partnering with New York Life Investments to do good for our planet.

The National Wildlife Federation believes America’s experience with cherished landscapes and wildlife has helped define and shape the country’s national character and identity for generations. It is committed to transforming wildlife conservation through the protection and restoration of wildlife habitat, environmental education, advocacy, and community engagement.

For wildlife, the impact of climate change is felt primarily through the disruption of habitats. Supporting cleaner modes of transportation is a way to reduce the emission of the gases that contribute to the degradation of these ecosystems, a shared goal of both CLNR and NWF.

Investment opportunity

Together, the transportation and clean energy sectors represent a major investment opportunity. The electric vehicle market alone is projected to grow from $140 billion to $700 billion by 2027. More broadly, the clean energy market is expected to hit $1.2 trillion by 2027, up from $408 billion currently.

CLNR is designed to provide exposure to this growth within an Environmental, Social, and Governance (ESG) investment strategy, where it can serve as either a core or satellite position. The fund tracks the IQ CANDRIAM Cleaner Transport Index, with holdings in a broad range of companies dedicated to a greener future. This includes manufacturers of electric vehicles and electric vehicle powertrains; multinational providers of energy and automation solutions designed for efficiency and sustainability; global producers of semiconductors and integrated circuits, and infrastructure providers, among others.

Reducing the carbon footprint of the global transportation network is imperative to addressing the challenge of climate change and to protecting the environment for both people and wildlife. Find out more about how to celebrate Earth Day (or any day) by investing in cleaner transportation.

All investments are subject to market risk, including possible loss of principal.

Click on the fund name link, which includes, the prospectus, investment objectives, performance, risk, and other important information. Returns represent past performance which is no guarantee of future results. Current performance may be lower or higher. Investment return and principal value will fluctuate, and shares, when redeemed, may be worth more or less than their original cost. Visit newyorklifeinvestments.com/etf and for the most recent month-end performance.

ESG Investing Style Risk Impact investing and/or Environmental, Social and Governance (ESG) managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating. There is no assurance that employing ESG strategies will result in more favorable investment performance.

“New York Life Investments” is both a service mark, and the common trade name, of certain investment advisors affiliated with New York Life Insurance Company.